Report urges serious consolidations for fragmented LED industry

A report into the latest status of the LED Industry has found that a number of factors created a a climate of overcapacity, price pressure, and strong competition.

“Growth of the LED industry came initially from small LCD displays and keypad backlighting for cell phones. Then, the industry was driven forward by medium and large LCD display applications, with LED TV expected as the LED industry driver for 2011. However, the reality was quite different due to lower sales of LCD TVs, a lower than expected penetration rate of LED technology and a lower number of LEDs per TV set”, explains Pars Mukish, Senior Analyst, LED, Lighting Technologies and Compound Semiconductors activities at Yole Développement.

The situation, mixed with the entry of several new players at the chip and device levels (mostly from Asia), created a climate of overcapacity, price pressure, and strong competition. Due to this, packaged LED volumes were sharply lower than expected and revenue shrank due to strong ASP pressure. In 2012, most companies started moving to the new “El Dorado” of the LED business: General Lighting, which represented the next killer application.

With the LED penetration rate greater than 5% in some applications (such as residential lighting, commercial lighting and road and street lighting), LED technology really started to spread beyond general lighting in 2013. To enable massive adoption of the technology, however, LED products will still require a cost decrease in order to be able to compete with incumbent technologies (halogen…). Further to this, the switch from a display driven market to a SSL driven market poses many challenges for the many LED manufacturers that are not vertically integrated all the way through to lamps/luminaires. T

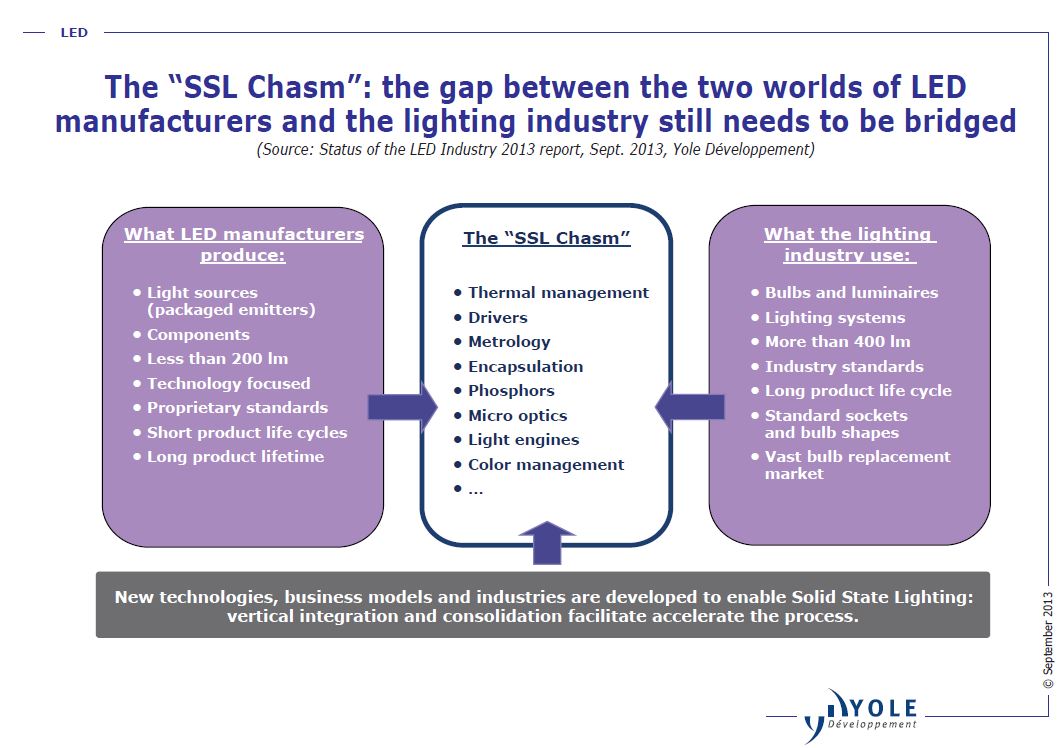

In 2013, LED technology really started to spread beyond general lighting, with the LED penetration rate greater than 5% in some applications (such as residential lighting, commercial lighting and road and street lighting). However, to enable massive adoption of the technology, LED products will still require a cost decrease in order to be able to compete with incumbent technologies (halogen…). Additionally, the switch from a display driven market to a SSL driven market poses many challenges for the many LED manufacturers that are not vertically integrated all the way through to lamps/luminaires.

The market is highly fragmented (in terms of applications and products), with the channels to market becoming much more complicated as they require a lot of commercial effort, and deal making with regional and local distributors. Also, engineering gets requests to develop many different types of LEDs for each customer (one-chip package, multi-chip package, COB….). The segment becomes a “low volume/high product mix” type of market without the benefit of commanding the usual high prices. The LED industry expects “low volume/high product mix” products to still be priced like commodities. And to makes things harder, the only “large” potential customers for SSL devices would be Philips Lighting, OSRAM and General Electric, but 2 of the 3 are vertically integrated and have their own source of LEDs that covers a large percentage of their needs.

In 2014, after years of anticipation, promises and excitement, General Lighting will no longer be “at the corner” for the LED industry. However, as explained, to successfully convert this opportunity into bottom line cash, the industry will have to undergo some major transformations, and many challenges await. First of all, the highly fragmented LED industry - with more than a hundred chip makers and thousands of packaging companies - needs some serious consolidations. Secondly, the paradigm changes of SSL implied that it’s no longer simply about making bulbs and sticking them into luminaires. To reap the full benefits of LEDs, products will have to be designed out of the box, almost from the chip to the final installation in our living room or city hall.