Opto market forecast to improve

Total O-S-D (Optoelectronics, Sensors/Actuators, and Discretes) sales rose to an all-time high of $58.6bn in 2013, according to information from IC Insights’ 2014 'O-S-D Report - A Market Analysis and Forecast for Optoelectronics, Sensors/Actuators, and Discretes'. This just beat the previous high of $58.2bn in 2012, when revenues also grew very slightly from record levels in 2011.

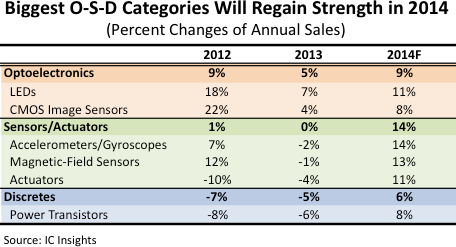

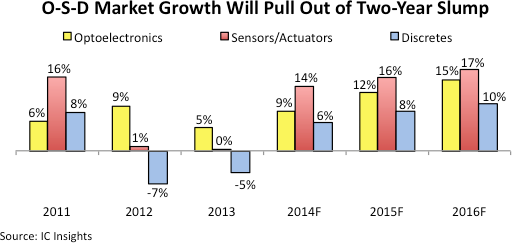

IC Insights expects total market revenues to rise by a more normal 8% growth rate in 2014, reaching a fourth consecutive record-high level of $63.5bn this year. Within this, optoelectronics grew about 9% to $31.6bn, sensors/actuators rose nearly 14% to $9.9bn, and discretes recovered from a two-year decline, increasing 6% to $22.0bn. The report predicts that all three O-S-D market segments will grow steadily until 2017, when the next economic slump is expected. After growth slows to about 2% in 2017, total sales are projected to rise 6% in 2018, reaching $86.4bn. This represents a CAGR of 6.4% in the five-year forecast period.

Despite weaker growth in 2013, combined sales accounted for 18.0% of the semiconductor industry’s total sales of $325.1bn. This shows a continuing upward trend following market shares of 16.0% in 2003 and 14.6% in 1993. In the next five years, the return of stronger sales growth is expected to increase O-S-D’s marketshare to nearly 20% of the projected $440.5bn total semiconductor sales in 2018.

The largest product categories declined in 2013. In optoelectronics, sales of LEDs grew just 7% primarily due to a slowdown in high-brightness LEDs for backlit televisions and falling prices from excess capacity in HB-LEDs. In image sensors, the second largest optoelectronics product category, sales declined 4% due to steep price erosion in CMOS imaging devices. Total sensors sales rose just 3% in 2013 with acceleration/yaw sensors falling 2% and a magnetic-field sensors also falling 1%. In discretes, power transistors continued to struggle in 2013 with sales dropping 6% after an 8% decline in 2012. This was the first back-to-back annual sales decline for power transistors in more than 30 years.